New mortgage rules aim to make homeownership more attainable, but a University of Guelph researcher suggests it might be time for society to reevaluate the need to buy a home at all.

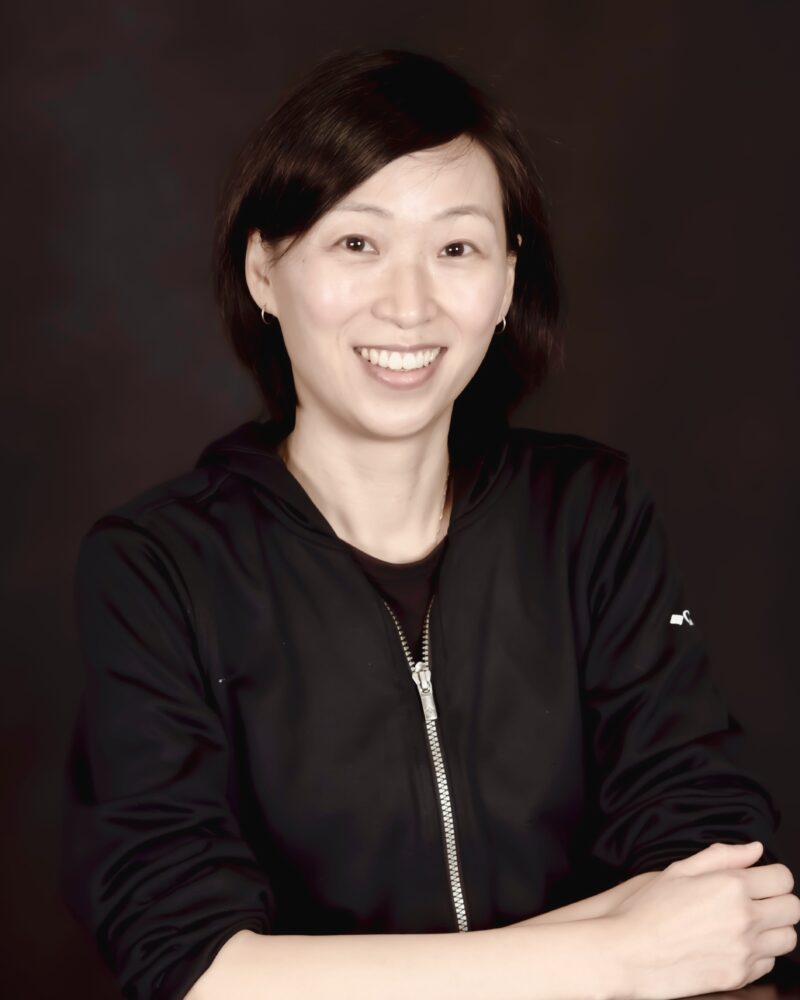

Dr. Diana Mok, a professor of real estate in the Gordon S. Lang School of Business and Economics, says new guidelines allowing for 30-year mortgages for first-time homebuyers are a stopgap solution to a system that really needs a complete overhaul.

“The Canadian housing market has reached a crisis point in the past five to 10 years as house prices have gone beyond reach,” Mok says.

She says the crisis has been particularly difficult for first-time buyers, since they don’t have existing equity to keep up with inflated prices. Longer mortgage terms could make homeownership more affordable in the short-term, but Mok says it will also put households at higher liquidity-risk over a longer period of time.

“Even if the household can afford the down payment and add a pricey asset to their balance sheet, that balance sheet expands at the expense of having a large debt,” she explains. “A longer term also subjects the mortgage holder to higher interest rate risks. Canadians who renewed their mortgages in the last two years can testify to the shock of needing an additional $500–$1,000 a month just to cover the higher interest cost.”

As housing prices continue rising to unattainable levels, Mok says it might be time to rethink why people feel the need to own a home at all.

“This illustrates the need to find other financial instruments that could allow Canadians to achieve benefits similar to homeownership even without owning a home,” she says.

Mok is available for interviews.

Contact:

Dr. Diana Mok

mokd@uoguelph.ca