By Dr. Sylvanus Kwaku Afesorgbor, Department of Food, Agricultural and Resource Economics, and Drs. Ruby Acquah and Yohannes Ayele, research fellows, University of Sussex.

This article is republished from The Conversation Canada under a Creative Commons licence. Read the original article.

China is now the African continent’s largest trading partner, accounting for US$254 billion in 2021. It’s also the main country of origin for African manufacturing imports, providing 16% of Africa’s total in 2018.

In most African countries the influx of Chinese products has become a major concern because of the implications for industrialization.

A flood of cheaper Chinese products could set back Africa’s infant or domestic industries. Domestic manufacturers that couldn’t compete would be forced to exit the market and would not create jobs.

There are serious implications for the continent’s economic development, because industrialization is widely seen as critical to improving living standards. There are also concerns about the impact Chinese manufactured exports are having on wages in importing countries.

We explored these issues in a recent paper. We analyzed the relationship between Chinese import competition and labour market outcomes as they related to women and men workers in Ethiopia. We merged a rich data set on manufacturing firms with trade data between 1997 and 2010. We mapped out the effect of import surges on labour force participation and compensation.

The impact of the influx of Chinese products in Ethiopia on employment and wages differed for men and women, we found. Employment levels declined overall for male and female manufacturing workers. But women bore a disproportionate burden. Manufacturing firms exposed to increased Chinese competition employed fewer female production workers than men.

Chinese imports and gender

Our findings matter because equality in the labour market is a starting point to improve women’s economic and social status. It also helps to improve their bargaining power in households.

The rise of Chinese imports has come at a time when most African countries have very low industrialization levels. Manufacturing’s share of GDP in sub-Saharan Africa declined from 17% in 1995 to 10% in 2010, before recovering slightly to 12% in 2021. Participation in global value chains is another measure of industrial development. The continent’s is still very low. Africa participates in global trade mostly by exporting natural resources and primary products.

It’s therefore important to look closely at the impact of Chinese trade relations on employment in the manufacturing sector. The comparison between male and female employment and wages is particularly notable for policy makers.

Evidence shows African women lagging behind men in most measures of economic opportunity. Women’s participation in the labour market is lower than men’s. And women workers earn less than men.

China and Ethiopia

China is the largest source of imports for Ethiopia.

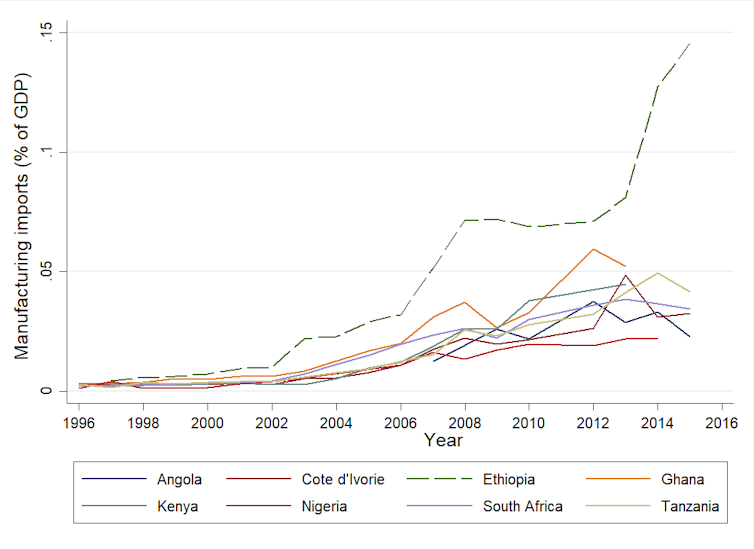

Figure 1 shows that Ethiopia imports more manufacturing commodities from China, in terms of percentage of GDP, than any other sub-Saharan African country. Ethiopia’s share of GDP spent on Chinese imports shot up from almost zero in 1996 to 15% in 2015.

Under competitive pressure from imported goods, Ethiopian firms usually lay off female production workers rather than males. Also, in labour-intensive jobs, firms have a preference for men because of their physical strength.

Total male employment hasn’t been adversely affected by the Chinese import competition. But wages of men in firms facing greater import competition from China have decreased. This implies that Ethiopian manufacturing firms cope with competition by cutting down on female employment and reducing male wages.

As low-wage competition from China has increased, Ethiopian manufacturing firms have reduced female production workers. This is most pronounced in firms that rely heavily on labour-intensive methods of production.

Lessons from the Ethiopian case

Africa’s trade relationship with China isn’t entirely negative for the continent. African countries have the potential to benefit from their trade relationship with China as well. Cheaper imports from China have the potential to generate jobs in wholesale and retail trade. Chinese import competition can potentially boost the incomes and job opportunities of women in informal retail trading in Africa.

In addition, if imports from China are dominated by inputs such as capital goods or heavy industrial machines, this could potentially boost the manufacturing sector in Africa.

But lessons from the Sino-Ethiopian relationship point to the need for African policymakers and leaders to be strategic in their interaction with China, to achieve mutual benefit.

African industrialization must not be sacrificed on the altar of cheap consumer goods from China or a one-sided trade relationship. The Africa Continental Free Trade Area can be used to achieve Africa’s industrialization, economic integration and transformation.

The free trade area can address market fragmentation, the small size of national economies, the lack of industrial capacity and the exportation of primary commodities to traditional markets of the north.

The industrial policies of African states must ensure that Chinese manufacturing investment diffuses technology to local manufacturing firms. It is especially important for African leaders to prevent the use of Chinese investment as a conduit to flood the market with cheap Chinese manufacturing imports that undermine local manufacturing.

Conversation Canada is always seeking new academic contributors. University of Guelph researchers wishing to write articles should contact Angela Mulholland, News Service Officer, at media@uoguelph.ca